Date: Wednesday February 25, 2015

Location: Menger Hotel, San Antonio TX

Breakout Session: Distance and Fuel “Stuck in the Truck” Audit Example Continued

Continue reading “17th Annual IFTA/IRP Audit Workshop: Day 2”

Date: Wednesday February 25, 2015

Location: Menger Hotel, San Antonio TX

Continue reading “17th Annual IFTA/IRP Audit Workshop: Day 2”

I recently attended the IFTA/IRP Annual Audit Workshop and it was a gas! I know not everyone can make it to these workshops so I wanted to share what I learned. Each bold heading below was an item on the agenda. Over the next three days, I’ll post up the notes I took for each day. I hope this is helpful to you! If you have any questions, or want to talk to me about the meeting, please call! I have copies of the agenda, the audit report, and many other fun things to share!

Date: Tuesday February 24, 2015

Location: Menger Hotel, San Antonio TX

Continue reading “17th Annual IFTA/IRP Audit Workshop: Day 1”

It has come to our attention that their has been a certain Nikki Johnson contacting people via phone demanding that they pay taxes owed to the IRS. Nikki Johnson threatens that if the taxes are not payed they can face jail time. Our customers that have made us aware of this situation, call us concerned because of course they do not want to be arrested or get into any kind of trouble with the IRS.

Route 66 was not intended to be an all American tourist attraction. Route 66 intent was to run across the U.S. in order to facilitate farmers with the transport and redistribution of their goods. Routes regularly used, prior to the construction of Route 66, were treacherous and uneven. Route 66 provided a flat drive from California to Chicago. It gave way for a safe and easy ride across the country. As with farmers, the Mother Road’s easy drive helped it gain popularity with many industries in the country. The Trucking Industry in particular gained momentum as it provided an easy and reliable way to transport goods. This new route helped make the Trucking Industry become an important competitor, giving the railroad a run for its money.

The Department of Transportation of Pennsylvania has issued a waiver lifting the requirement to comply with driver hour of service. Due to the extreme weather the State of Pennsylvania is currently facing, the Governor of Pennsylvania has found it necessary to issue a temporary waiver for all motor carriers engaged in necessary emergency transportation.

The state of Virginia has declared a State of Emergency due to the expected winter storm projected by the National Weather Service. As a result, the state of Virginia has issued a waiver for carriers transporting emergency relief supplies. Such emergency relief supplies include livestock or poultry, feed or other critical supplies for livestock or poultry, heating oil, motor fuels, and propane, or vehicles providing restoration of utilities such as electricity, gas, phone, water, wastewater, and cable.

The state of Virginia has declared a State of Emergency due to the expected winter storm projected by the National Weather Service. As a result, the state of Virginia has issued a waiver for carriers transporting emergency relief supplies. Such emergency relief supplies include livestock or poultry, feed or other critical supplies for livestock or poultry, heating oil, motor fuels, and propane, or vehicles providing restoration of utilities such as electricity, gas, phone, water, wastewater, and cable.

Did you know that 6.8 million people in the U.S. are employed within the Trucking Industry with nearly 3,500,000 truck drivers. That may seem like a lot but in reality the Trucking Industry is facing massive shortages in truck drivers. In fact, the shortage is estimated to be about 25,000 truck drivers in the U.S. There aren’t enough truck drivers to meet demand. As the economy flourishes, the need for experienced and reliable drivers is expected to increase. As a result, an increase in wages for our hard working truck drivers is also expected to increase.

The California State Board of Equalization has issued the Diesel Fuel Tax Law section 60212 that waives penalties and interest for late 4th quarter 2014 filing. Due to the new return processing system introduced in late 2014, the Motor Carrier Office has not been able to assist agents and taxpayers in a timely manner. As a result, taxpayers and agents have not been able to file returns on time. The Board issued a statement saying that “if your fourth 2014 (4Q14) filing has been delayed due to board staff not being able to assist you in a timely manner, you may request relief from penalty and interest.” The Board will not penalize any one due to their “unreasonable error or delay.”

Continue reading “California State Board of Equalization: 4Q14 Relief”

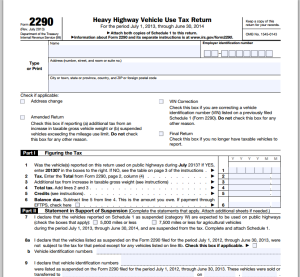

It isn’t unusual to make mistakes on a tax form so don’t feel like you are the only one. The good thing is that there are ways to correct them. Filing an amended tax form is an option that is available to correct a mistake. Their are only three types of corrections that can be made electronically: vin correction, change in vehicle weight, and mileage limit exceeded, however any other type of corrections can be submitted through paper form.

Decals have often been the source of frustration for many hard working truckers. Decals are stickers issued by a state agency that are attached to the exterior of a truck. They validate its current permission for operation in compliance with the law. IFTA is exploring the idea of going digital to eliminate the need of decals.

Continue reading “Electronic Systems Possibly Replacing IFTA Decals”