The IRS said they would begin auditing Form 2290, and we’re starting to see it happen when suspended vehicles are reported. It seems the IRS is looking for PROOF that the mileage stayed below the maximum limit, and they are assessing taxes if the documents they want aren’t provided or if the documents provided indicate the vehicle traveled in excess of the mileage limitation.

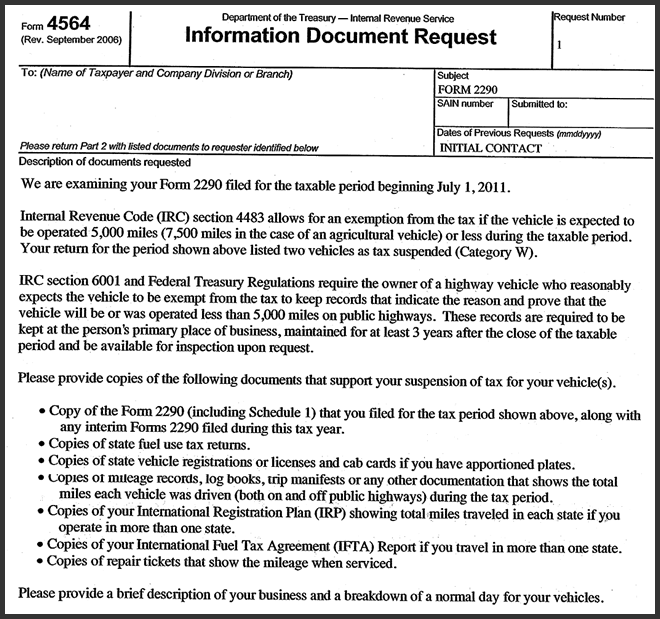

Form 4564 (pictured below) is used to request records relating to Form 2290 from a taxpayer.

General Things you should know about Form 4564:

First – There are a LOT of laws, IRS codes, and Treasury Regulations here. If you want to review the specific code or form referenced if you search for it on the IRS website.

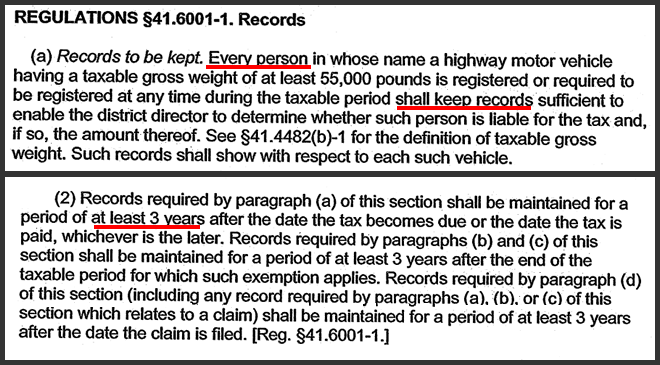

Second – Ignorance is not bliss. If you don’t know the law, you’ll still suffer for breaking it, even if it’s not fair. The audit period is 3 years, but I recommend keeping ALL your records (Form 2290, IFTA, DOT log books, everything) for 5 years just to be safe.

Third – I’m going to make this easy. The whole point of this article is that you need proof of the mileage traveled if you say you will travel less then 5,000 miles (7,500 miles for agricultural vehicles). That’s it. Keep it simple.

Form 4564 – Information Document Request

This is an, “Information Document Request.” I’m going to do my best to simplify it, so below are only the REALLY important parts. The thing to remember is that all this form is asking for is proof that the vehicles you listed on your Form 2290 as suspended really were suspended. You should be keeping records, the IRS just wants a copy.

The Right Kind of Records

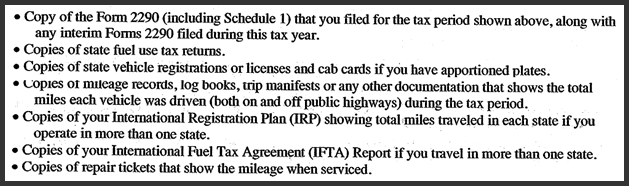

Lets talk about acceptable forms of records. According to the Form 4564, copies of the following are acceptable:

- Fuel Use Tax Returns.

- State Registration, Licenses or Cab Cards.

- Mileage records, log books, trip manifests etc.

- IRP Schedule B miles – used for IRP Registration.

- IFTA Tax Reports

- Repair Tickets and Maintenance Receipts

But what if your truck didn’t move at all so there are no records? Or you don’t deal with IFTA, or IRP Registration? Or what if you didn’t keep your DOT log books for more than the DOT required 6 months? If you REALLY can’t get any of the records above, here are some other ideas that MIGHT work:

- A Dated Picture of your Odometer. Take a picture of your Odometer each June 30th and July 1, and email it to yourself as evidence of the odometer and the date. These two pictures will cover the close of the previous tax year and the open of the next tax year.

- A copy of your truck insurance policy schedule of vehicles indicating the vehicle was not insured or had coverage changed due to the fact it was not operating during the taxable period.

- A copy of your income tax return that indicates your fuel expense was lower or no fuel expense was incurred for the year.

- Try combinations of the above. Some of the above records individually don’t get the whole job done.

- Another Option – ask your auditor or propose your own suggestions to them.

If you have ever talked to me on the phone, you know one of my favorite things to say is that there is always more than one way to skin a cat. This is no different. It’s worth talking to your auditor and polity explaining your situation and asking questions. In my experience, they are polite, accommodating, and good to work with.

Record Keeping

Record Keeping is how you protect yourself before an audit, how you prevent penalties during an audit, and how you laugh at an audit when it’s over. When you have the right records, and have kept them for the right amount of time an audit won’t scare you a bit.

Remember to keep EVERYTHING relating to your truck for 5 years just to be safe. For Form 2290, that means whatever proof you selected from the list above, you need to have handy for the entire 3 year audit period.

Penalties

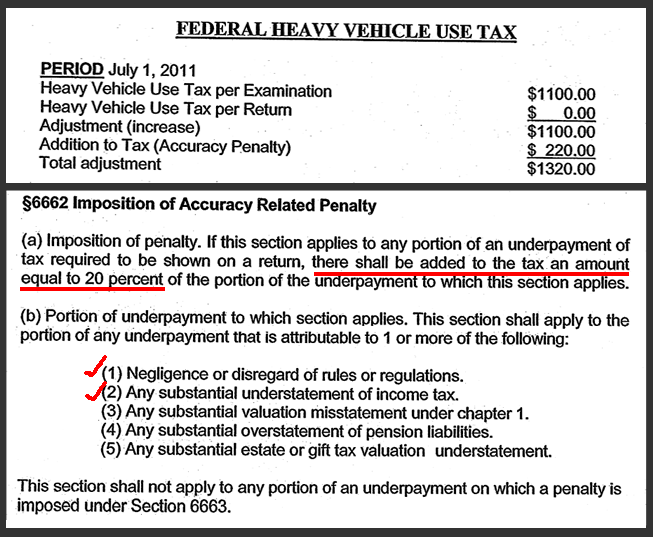

Penalties are always a concern when it comes to audits. In this case the IRS can tack on an additional 20% of the taxes due in penalties if they determine you filed inaccurately. That’s $110 per 80,000lb truck!

In plain English, the picture above means that if you forgot to keep records, or didn’t keep the right kind of records AND didn’t pay the right tax originally – you owe the extra 20%. In the example above, the owner had two suspended trucks and he owed $0.00 taxes at the time of filing. Now that he can’t provide the requested records, he owes not only the original $1,100 in taxes, but also an extra $220 in penalties, bringing his total to $1,320!!

Don’t let this happen to you!!

Summing Up

- Make the right kind of records.

- Keep them for the right amount of time.

- Don’t get stuck with penalties.

Always feel free to call us here at 2290Tax.com if we can help you understand an IRS notice. We want to help you!

The Disclaimer

I’m not a CPA, enrolled agent, or attorney. That means I can’t, and don’t interpret the law. I’m just a regular person who happens to take care of a lot of this kind of thing for lots of different people. While I have experience, I don’t have lots of fancy education, training or certifications. So in this series of articles (as in all of my articles) I’m just sharing my experience with you. Telling you how I’ve resolved things in the past, or what I’ve been told by the IRS when I call with my own questions. No guarantees that my advice is perfect or that it works every time! It’s just what works for me…

2290Tax.com is one of a handful of preferred providers to e-file IRS Form 2290. Please feel free to contact us with any questions.