Our last article discussed how to figure out the correct name for your Form 2290. But what if you already filed with the wrong name? What if your local tag office won’t take what you have and they are demanding something different?

Here at 2290Tax, we are asked to make corrections to forms that have already been accepted and stamped by the IRS. The good news is that we can help you make some of those corrections; the bad news is the IRS makes that Schedule 1, and they stamp it. So if there is a hitch, they have to be the ones to fix it.

Common Corrections

The most common kind of correction we get asked for are name corrections. There are many kinds of name corrections. I’ll outline them all below, along with how-to instructions for fixing it.

A little advice that applies to ALL the circumstances below. Usually, getting what you want is as easy as calling the IRS directly and asking nicely for help.

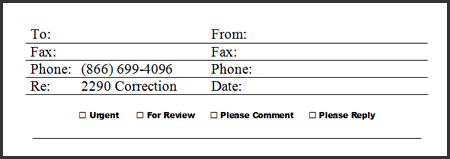

IRS Toll Free: 866-699-4096

International: 859-669-5733

I personally catch more flies with a drop of honey then a gallon of vinegar, so I always recommend being super polite even if you’re really gnashing your teeth. You should also write down the name and badge number of anyone at the IRS you speak with. My last bit of advice is that if you don’t get what you want, then hang up and call back to speak with a different representative. Sometimes the initial person you get is new or doesn’t have a lot of experience with Tax Form 2290, or they have never been asked a question like yours before. Give it another shot if you don’t get what you want on the first try!

Easy Corrections

The examples below are the most typical type of corrections. They are also the easiest to fix with the IRS. You’ve got a Stamped Schedule 1 with the right EIN, but there’s a problem with the company name. In all the cases below, you will likely fax a corrected Schedule 1 to the IRS. It usually takes them about 3-5 business days to review it before they stamp it and fax it back.

The Typo

Example: The not Teh – or – James not Jimmy – or – Transport not Transportation

In the case of a simple typo or misspelling, corrections can be made by the IRS. Call them and explain as simply as possible that you made a typo on your accepted Schedule 1. Ask politely if you can fax them a corrected Schedule 1 for them to stamp and fax back.

Business Name vs Personal Name

Example: John Smith not Smith Transport – or – Davidson Farms not Eric Davidson

In there is a mix up between your company name and your personal name, corrections can be made by the IRS. Call them directly. They will need to confirm the correction you want exactly matches the EIN on your already accepted Schedule 1. They can only make a correction that matches what the file already shows. Once that is confirmed, they should give you a fax number and ask you to send them an unstamped Schedule 1 with the correct name. They will stamp it and fax it back, usually within about 3 business days.

Business Name vs DBA Name

Example: Adam Jones not DBA Go Truckin Transport

In the event that you use a DBA instead of your official business name, corrections can be made by the IRS. They still need to confirm that the correction you want matches their files. As soon as they do, they will ask you to fax over a corrected Schedule 1 for them to review, stamp and fax back.

Rough Corrections

The examples below don’t come up very often but are the hardest to fix – if they can be fixed at all! From the IRS perspective, these aren’t really corrections, these are taxpayer mistakes.

Wrong EIN

Sometimes, 2290 taxes get paid with the wrong EIN and company name. In this case, the IRS cannot make a correction. A Brand New Form 2290 must be filed in the correct EIN and business name, and taxes paid again. You can apply for a refund with Form 8849 and Schedule 6, but there’s no guarantee.

Anything Else

That about covers the types of name corrections we’ve come across so far. If you think you have a situation not covered here, please call us. We’ll do everything we can to help.

|

|

|

|