Penalties and Interest are a bummer. Sometimes it’s unavoidable, sometimes it’s not that bad, and some times you can get out of penalties. But it’s always a bummer to get this piece of paper in the mail.

Z

It’s usually a 5 page notice, depending on how many trucks you have, and how complicated the math gets. If you get one of these in the mail, don’t despair! We’re here to help – and the news isn’t always a grim as you might think.

General Things you Should Know

First – All IRS 2290 Notices are sent by a computer, so they are usually confusing and often sent too early, too late, or too often. In the height of the tax season, HVUT Penalty Notices have even been sent in error. Always take everything the IRS mails you with a grain of salt, but never disregard anything. It’s always worth a phone call to double check that the notice you received is accurate. You can call them using the numbers listed below.

IRS HVUT Hotline – Toll Free: 866-699-4096

IRS HVUT International Hotline: 859-669-5733

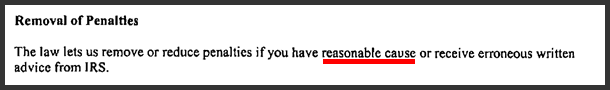

Second – It’s pretty easy to get HVUT Penalties waived if you’ve never asked before. You can read the full details about How to Get HVUT Tax Penalties Waived here, but usually it’s easy and straight forward. The penalty notice we’re talking about now even says they can remove penalties.

Third – I’ll give you some detail below about how HVUT Penalties and Interest are calculated, but the nice thing about the HVUT is that the penalties really aren’t that high when compared with other taxes. For example, California IRP starts penalties at 10% and they quickly go up-up-up from there. While no penalty is a good penalty – HVUT Penalties are smaller than most.

The Math

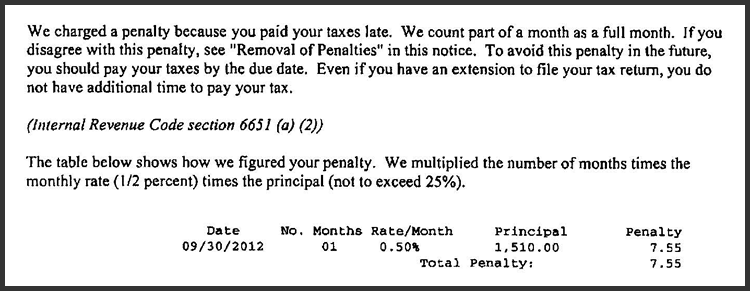

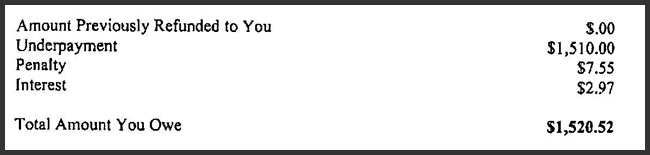

The IRS calculates HVUT Penalties with a simple math equation. Take the number of months you’re late, multiply that by the penalty rate of 0.5% and then multiply that by your total taxes due. You can see an example below where the total penalty is less then $10.00.

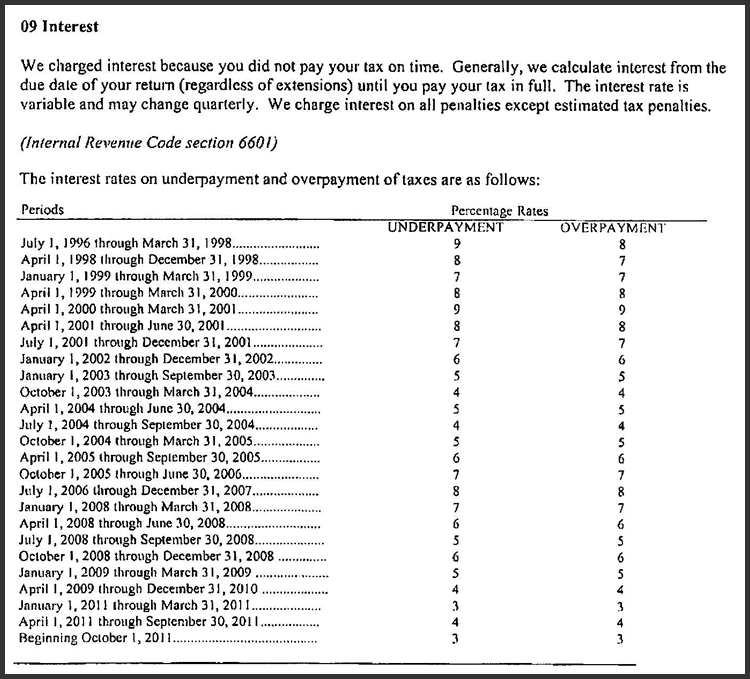

HVUT Interest is a whole different story. They give you the table below to help explain what they are doing – but it lists different interest rates from the past 15 years, and that doesn’t apply to most HVUT filers. Let me simplify this. The IRS adds interest to your HVUT penalty at about 3%.

In this case about $3.00 more dollars. So in this example of three trucks, filed 1 month late, the owner owed less then $15.00 in penalties and interest on top of his taxes for filing and paying taxes late. These are rounded numbers, and each form is different – but it’s a good starting point.

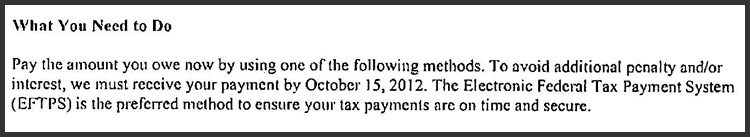

What You NEED To Do

If you really did pay your taxes, you should call the IRS at 866-699-4096 and provide them with proof. A copy of your bank statement, the canceled check, or the EFTPS receipt will all work. When you call, they may give you a fax number so you can send it directly to the person you’re speaking with. They can then resolve your issue while you’re still on the phone. Or, they may ask you to mail in your proof and give you a mailing address and instructions. Either will work.

If you didn’t pay your taxes, the faster you can pay up the better. The IRS can only add up to 25% of your original taxes to your bill in HVUT Penalties, but the interest can keep racking up for years.

On page 2 – you should see a basic summary of your amount due:

This tells you exactly what dollar amount they expect you to pay. Finding this section was a lot easier for me then trying to calculate the penalties and interest on my own because I’m not a big fan of math. The IRS will also always include a communication and payment voucher on the last page and this will also have the amount due.

Zero Penalty Goal

Here at 2290Tax.com, we have a zero penalty goal. We want 100% of our customers to pay $0.00 in HVUT Penalties and Interest. Each of us already gives the government too much of our hard earned cash, and that’s a bummer!

There is only one way to get out of HVUT Penalties and Interest for sure – and that’s to pay taxes on time. We do everything we can to help remind everyone by sending out email notices, making phone calls, and writing articles like these! But we can’t do it without your help! Please pay special attention to our emails (they almost always contain a promo-code to save you $$$) and call us any time with questions. That’s why we’re here! Answering questions, and making your lives easier is what we do!

If you want to get our annual reminders, just Register today.

The Disclaimer

I’m not a CPA, enrolled agent, or attorney. That means I can’t and don’t interpret the law. I’m just a regular person who happens to do this a lot. While I have experience, I don’t have a fancy education, training or certifications. So in this series of articles (as in all of my articles) I’m just sharing my experience with you. Telling you how I’ve resolved things in the past, or what I’ve been told by the IRS when I call with my own questions. No guarantees that my advice is perfect, or that it works every time! It’s just what works for me…most of the time…

Call us…

If this worked for you, or didn’t work for you. If this made sense, or just added to your confusion. If you have more questions, or just want to talk…

Call us!!

We’re here to help with any HVUT e-file questions. We want to help. From our family company to yours – we’re here for you!